Federal Reserve Chair Jerome Powell said Monday that the central bank will not wait until inflation hits 2% to cut interest rates.

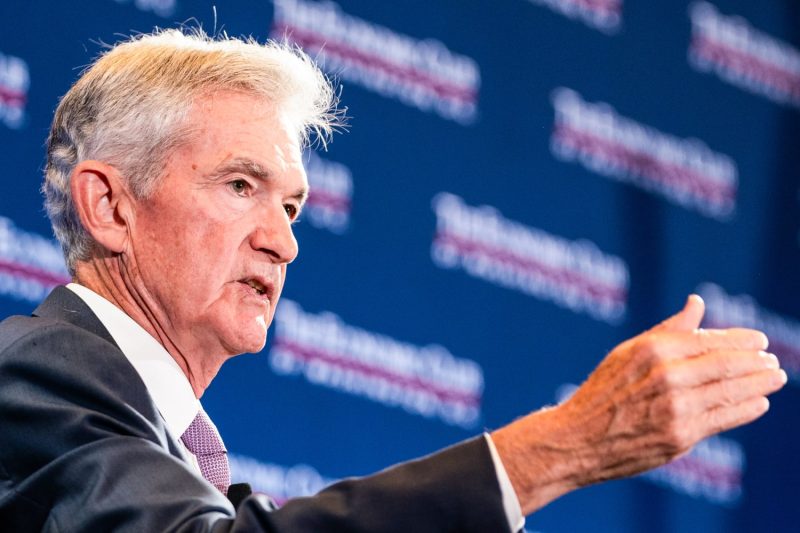

Speaking at the Economic Club of Washington D.C., Powell referenced the idea that central bank policy works with “long and variable lags” to explain why the Fed wouldn’t wait for its target to be hit.

“The implication of that is that if you wait until inflation gets all the way down to 2%, you’ve probably waited too long, because the tightening that you’re doing, or the level of tightness that you have, is still having effects which will probably drive inflation below 2%,” Powell said.

Instead, the Fed is looking for “greater confidence” that inflation will return to the 2% level, Powell said.

“What increases that confidence in that is more good inflation data, and lately here we have been getting some of that,” he said.

Powell also said he thinks a “hard landing” for the U.S. economy was not “a likely scenario.”

Monday was Powell’s first public speaking appearance since the Consumer Price Index report for June showed cooling inflation, with prices actually falling month over month.

Powell said at the beginning of his appearance that he was not intending to make any signals about when the Fed might start to cut interest rates. The central bank’s next policy meeting is at the end of July.

Powell made the remarks as part of a discussion with David Rubenstein, chairman of the Economic Club of Washington, D.C., and co-founder of The Carlyle Group, where the Fed chair previously worked.

The target range for the federal funds rate is currently 5.25% to 5.50%. That is up from a range of 0% to 0.25% during the Covid-19 pandemic, and a range of 1.50%-1.75% before that health crisis.

The federal funds rate influences, directly or indirectly, the cost of money throughout the economy, such as mortgage rates.

“People I don’t know will always say, ‘hey, cut rates.’ Somebody said that in the elevator this morning,” Powell said jokingly.